Summary

- AT&T continues to predict a return to revenue growth leading to ~1-2% CAGR from 2020-2022.

- A return to growth relies on a 5G boost to Mobility revenues that appear unlikely as 5G services aren't charging higher fees.

- The company is unlikely to reach internal targets based on a recent history of revenue declines.

- My $42.50 price target values the stock at a 2022 P/E of ~10.5x.

Almost monthly, AT&T (T) executives parade out the same tired financial projections via a press release. My previous research highlighted the unlikely reality of the wireless giant reaching those relatively simple goals of achieving ~1-2% CAGR from 2020-2022. My price target values the stock at about $42.50 due to the likelihood of revenue declines causing the market to lose confidence in management.

Image Source: AT&T website

Constant Revenue Declines

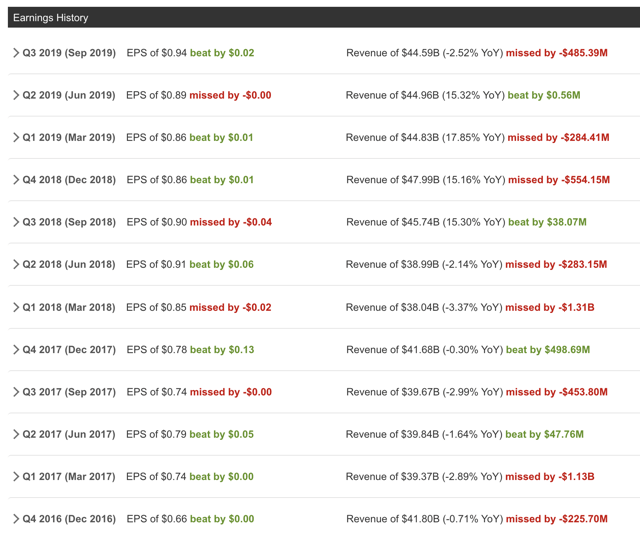

Part of the problem with AT&T is that a couple of major mergers in the last few years makes historical data hard to analyze. One only has to look at the earnings history of the wireless and media giant to see that before and after the four quarters impacted by the inclusion of Time Warner revenues, the company had revenue declines. The company saw revenues dip 2.1% in Q2'18 before completing the merger and revenues were down 2.5% in the last quarter as AT&T lapsed the merger.

Source: Seeking Alpha earnings

For the nearly two years prior to completing the merger, AT&T saw revenues decline. Prior to this period, the company closed the DirecTV deal were revenues were ramping as the move to 4G was driving wireless growth and T-Mobile (TMUS) wasn't a threat yet.

Clearly, AT&T has no recent history of growing revenues. One has to highly question how the company can promise an at least 350 basis point improvement from the recent negative 2.5% trend to reach 1% revenue growth.

AT&T generates about $44.6 billion in quarterly revenues. The company has to reverse what was a $1.15 billion loss in revenues into an at least $0.46 billion increase in revenues for a ~$1.6 billion quarterly trend change starting in 2020.

The company lists wireless, WarnerMedia and Mexico as the primary revenue growth drivers in 2020 due to 5G and HBO Max. The problem here is that HBO and Mexico only account for about $2.5 billion in combined annual revenues. The real driver of growth has to come from Mobility via 5G and the Entertainment Group is crushing the division due to cord cutting.