Summary

- After AT&T shares gained more than a third in value this year alone (excluding dividends), the question naturally arises as to whether catalysts are available for further price increases.

- There are several reasons to doubt that an investment can add value to shareholders. However, I am convinced that the company can create high added value for any diversified portfolio.

- By implementing a market platform for ads and using synergies of the Time Warner merger, the long-term strategic approach looks quite promising.

- Additionally, all this is backed by a good debt management and safe dividends.

Introduction

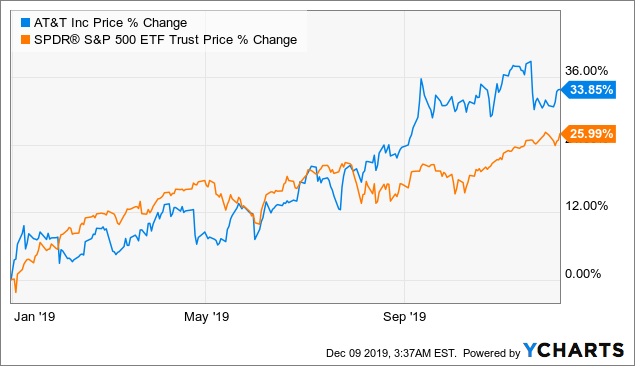

This year AT&T has given its shareholders pleasure through its share price performance. The company even outperformed the S&P 500. AT&T (T) a tough case. The years before, on the other hand, were much more marked by disappointing price gains. This was particularly disappointing because otherwise the market performed very well.

Data by YCharts

Data by YChartsAfter the company has gained more than a third in value this year alone (excluding dividends), the question naturally arises as to whether catalysts are available for further price increases. In particular, the following arguments are brought into play. On the one hand, the record indebtedness after the USD 85 billion Warner merger was pointed out by investors. With the reference to the acquisition of DirectTV, the validity of the merger in particular was questioned too. Many investors criticize the fact that AT&T is entering a field now where there is extreme competition.

In addition, many investors criticize the high losses of subscribers. Last quarter, the company reported a net loss of 1,163,000 customers in the premium TV category. This category includes AT&T's DirecTV satellite and U-verse wireline TV services. Additionally, AT&T had to report that it lost 195,000 customers of AT&T TV Now (DirecTV Now). Given that, since 2016, AT&T has lost nearly 5 million TV subscribers (satellite-and-wireline).

Nevertheless, I believe that there are some catalysts that can give shareholders value in the medium and long term which I want to outline in the following analysis.

Catalysts for shareholders value

When it comes to further growth catalysts, the first thing to mention is the merger with Time Warner. So indeed, with this acquisition AT&T entered the market of streaming and indeed, this market is highly competitive. By next year we will have a highly fragmented market with some really big players like Disney (DIS), Apple (AAPL) and of course Netflix (NFLX). So yes, you could see it in a way that AT&T is leaving its highly regulated core business (that even might cannibalize its own satellite business). Besides that, this is true as well, you could see the acquisition in a way that AT&T is now entering a growing future market. Furthermore, you can just point out to the fact that a growing and relatively conservative future market remains a growing relatively conservative future market. This cake is very big and so there is nothing to prevent AT&T from getting more and more of this cake, even if the share of the cake itself does not increase. Given that I would say, that it is not the worse if a company like AT&T has a foot in such a great future market.

However, and here is the decisive factor from my perspective, all this does not reflect the extraordinary position AT&T has. As I said in a former analysis, the management of AT&T is transforming the company into a giant whose telecommunications and advertising business is generating unprecedented synergies. It is a fact that consumers spend more time on advertising media and that overall media time is increasing. And indeed, ad-supported media consumption accounts for a remarkably large proportion of total media consumption: