Summary

- CyrusOne's growth is strong, with a robust development pipeline.

- The company has the potential for double-digit medium-term returns, even with prudent growth projections.

- Competition risks remain, but the company makes for a high-quality pick.

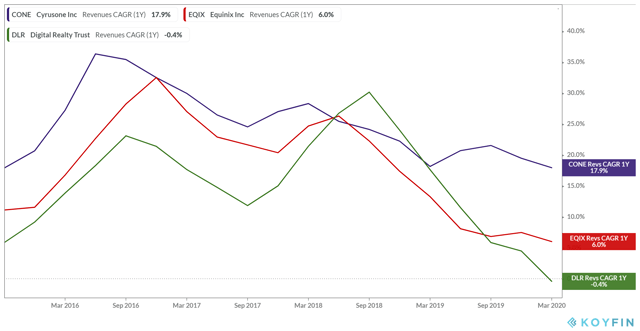

CyrusOne (CONE) provides mission-critical data center facilities that guard and ensure the maintained operation of companies and their IT departments. The company's plan is focused on enticing customers that have not historically outsourced their data center needs. CyrusOne has approximately 1,000 customers, including 200 of the Fortune 1000 companies, which is testament to its well-run services. The company operates data centers in the United States, Europe, and Asia. Through its properties, it provides customers the opportunity to scale and to match their unique growth demands flawlessly. The company is the third-largest U.S. REIT, only behind Equinix (EQIX) and Digital Realty Trust (DLR), with a market cap of around $8.6B.

Supported by the high demand for data and server storage, CyrusOne is currently the fastest-growing U.S. data center REIT. Since the coronavirus outbreak, many real estate sectors have been adversely affected, like retail as well as offices, to some extent. In the meantime, data centers have been attracting additional demand, as businesses strengthen their online presence, requiring extra server spaces. Combining the growth-opportunity exposure of tech and the reliable cash flows of real estate, data centers have captivated the interest of investors who want to enjoy both growing dividends as well as capital appreciation.

In this article, we will:

- Examine CyrusOne's future growth and profitability prospects

- Assess the medium-term return potential of the stock

- Highlight some risks

- Conclude on why CyrusOne is a great stock to own

Future growth and profitability

CyrusOne has seen incredible growth over the past few years, boasting a 5-year revenue CAGR (Compound Annual Growth Rate) of 24.2%. As data center providers mature, their growth is gradually declining. However, the company still grew by almost 18% over the past year, boasting as the U.S.'s fastest-growing data center REIT. In its latest earnings report, the company announced it had increased its total footprint to 891 MW (Megawatts), 19% higher than the year before. We believe that growth should continue strong for CyrusOne, based on its robust development pipeline. During the quarter, the company delivered 50K of new square feet, while there are 438K more in development. Around 63% of these are to be constructed in the U.S., while the rest are intended for Europe.

The REIT's profitability should not only be expanding by the continuous additions of properties but also from rent escalations. Around 76% of the company's leasing contracts are attached with annual rent increases, typically ranging from 1-3%. Additionally, because around 70% of the REIT's leasing contracts expire within six years, management retains the power to renegotiate higher rates that reflect the current market environment.